New Digital Payment Regulations Take Effect in Ireland

Ireland has officially implemented comprehensive digital payment regulations that will significantly impact how consumers manage their prepaid accounts and access online services, including popular mobile top-up platforms.

Enhanced Consumer Protection Framework

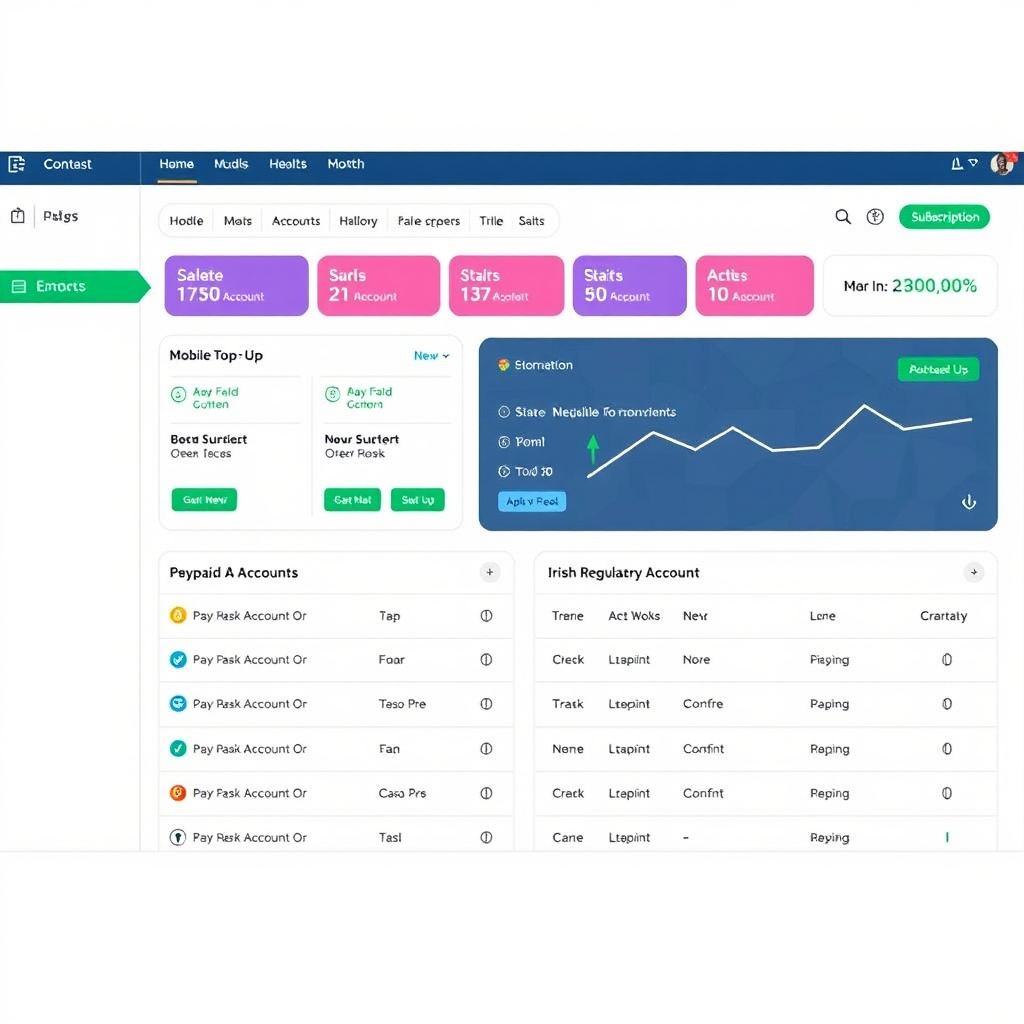

The new regulatory framework introduces stricter oversight for digital payment providers, particularly those offering mobile top-up services and prepaid account management. These changes aim to create a more secure environment for Irish consumers who rely on digital platforms to manage their everyday connectivity needs.

Under the updated regulations, service providers must implement enhanced verification processes while maintaining user-friendly interfaces. This balance ensures that customers can continue to enjoy and convenient access to services like eir mobile top-up and other essential digital services without compromising security.

Impact on Mobile and Prepaid Services

Key Changes for Prepaid Account Holders:

- Improved transaction transparency and real-time balance updates

- Enhanced security protocols for online top-up processes

- Streamlined dispute resolution procedures

- Better integration between service providers and digital platforms

The regulations particularly focus on improving the experience for users who frequently manage multiple prepaid accounts and subscriptions. Digital dashboard platforms that help organize these services will benefit from clearer operational guidelines and improved data protection standards.

Streamlined Digital Transactions

One of the most significant improvements under the new regulations is the standardization of digital transaction processes. This means that whether users are topping up their eir mobile accounts or managing other prepaid services, they can expect more consistent and reliable experiences across different platforms.

The regulations also mandate better integration between traditional telecommunications providers and modern digital management tools. This integration will make it easier for consumers to track their spending, monitor account balances, and receive timely notifications about service renewals or low balances.

Implementation Timeline and Next Steps

The phased implementation of these regulations began in early November 2024, with full compliance expected by the end of the first quarter of 2025. Service providers have been working closely with regulatory bodies to ensure smooth transitions that minimize disruption to existing customers.

For consumers, these changes represent a significant step forward in digital payment security and convenience. The new framework supports the growing trend of consolidated digital management platforms that help users organize their various online services and prepaid accounts in one convenient location.

What This Means for Irish Consumers

The new regulations create a more secure and user-friendly environment for managing digital payments and prepaid services. Users can expect improved transparency, better customer support, and more reliable service delivery across all digital platforms.

These changes particularly benefit those who use digital tools to organize multiple subscriptions and prepaid accounts, making everyday connectivity management more efficient and secure.

As Ireland continues to embrace digital transformation, these regulatory updates position the country as a leader in consumer-focused digital payment governance. The emphasis on both security and usability reflects a mature approach to regulating the digital economy while supporting innovation in financial technology.

The successful implementation of these regulations demonstrates Ireland's commitment to creating a digital ecosystem that serves both consumers and service providers effectively, ensuring that the country remains at the forefront of digital payment innovation in Europe.